PairSoft

The strongest AP automation, document management, procurement, and fundraising automation platform for mid-market and enterprise companies with integrations to your ERP system.

View all posts by PairSoftPairSoft •January 9, 2020

In most organizations, Procurement and Accounts Payable (AP) departments operate independently from one another for most of their respective process lifecycles. The departments’ teams conduct their business under different policies and have separate strategies for functioning efficiently. This siloed environment is partly due to their differing goals: Procurement tends to have more of an operational focus, while AP’s focus is financial. However, the two departments have more in common than is often acknowledged, as they both ultimately work to improve the health and strength of their organization’s cash flow and bottom line.

In any Procure-to-Pay (P2P) process, there comes a point when the Procurement department must pass on the purchase order (PO) and related documents to Accounts Payable, creating a point of natural synchronization. Although it is not necessarily the status quo, a more efficient way to run the back office is by expanding that synchronization to the entire P2P lifecycle, creating a place for AP in Procurement and a place for Procurement in AP. This can be accomplished by combining the two departments through a holistic and carefully planned integration initiative. By treating the teams as two unique but complementary parts of one whole, organizations can increase their control over spend, lower their costs, and improve their competitive advantage.

One of the best ways to begin this integration process is by implementing a holistic Procure-to-Pay software platform that automates purchasing and AP functions. Automating the two departments helps to ensure a more streamlined, efficient, and controlled integration than a manual initiative alone. P2P software platforms have built-in controls and advanced technical integration capabilities that make it simple for companies with many different internal teams, locations, and strategies to consolidate processes into one digital environment.

In order for organizations to successfully unite purchasing and payables, they should educate themselves on the risks and benefits of an integration project, as well as the support tools available to them to lower risk and increase efficiency. This report includes integration trends among North American purchasing and payables departments, a set of best practices that will help organizations build an integration initiative plan, and a high-level overview of P2P software.

There are several incentives for companies to integrate their Procurement and Accounting departments—and there are several reasons not to. The risk-benefit ratio will typically help determine if an organization should or should not integrate. Some of the benefits of integration include lower costs and higher savings. These are mostly associated with workflow—by shortening the time and steps necessary for purchasing, invoice management, and payment lifecycles, organizations reduce their processing costs. Faster cycles can also lead to increased discount capture through early-payment discounts. In some instances, companies can also save on labor costs, as they can consolidate certain roles within one department.

Another benefit of integration is increased visibility into spend and employee activity, which allows organizations to pinpoint

maverick spend, fraudulent activity, or inefficient purchasing from noncompetitive or outdated vendor contracts. Bringing spend previously managed by two different teams under one umbrella allows companies much more control over that spend, and enables them to use their resources more strategically.

The risks of integration are mostly built upon the fear of change, and doubts of whether or not change can be implemented without disrupting the status quo and harming the company. Integration can create burdens on different teams and processes, including the IT department. Consolidating internal systems is a complex and time-consuming process, as Procurement and Finance teams are often using several different technologies even within their own departments. Consolidation creates a short-term stretch on IT, as it often warrants hiring additional labor to help with the process, such as IT consultants or integration specialists. Integrating can also be disruptive on Procurement, as many Procurement teams are used to

having a certain degree of autonomy when it comes to their purchasing decisions.

Another risk of integration is the time it takes overall, and the effect this can have on supplier relationships and supply chain efficiency. Even a fairly simple and brief integration project can disrupt supplier and payment processes to some degree. The possibility that the project will hit unexpected difficulties that will draw it out is also a concern. A change in roles and activities could also disrupt long-standing routines and equilibriums, as differing management policies and ideologies can create some tension between departments forced to integrate. For example, a Procurement professional could be wary of iinvolving new Finance contacts in an established, but sensitive, supplier relationship; while Accounting professionals could be resistant to giving Procurement members the power to weigh in on finance reports without years’ worth of context.

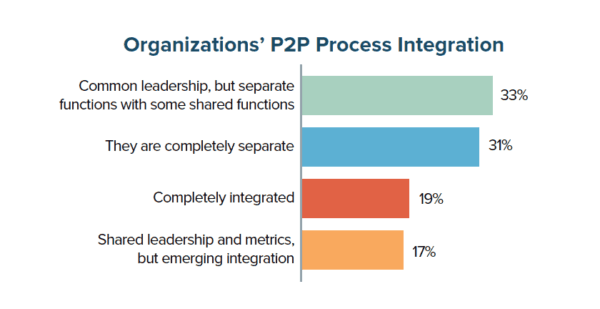

Despite these concerns, many organizations are heading toward a more integrated back-office environment for the cost savings, control over spend, and higher productivity integration brings. According to Levvel Research’s research, today’s organizations are typically not fully integrated, although the majority of organizations have some degree of integration or are headed in that direction. When asked to describe their current state, 33 percent of companies reported that they have common leadership but most of their functions are separate, while 31 percent reported they are completely separate, see Figure 1.

“How would you describe the process flow between Procurement, AP, and Payments?”

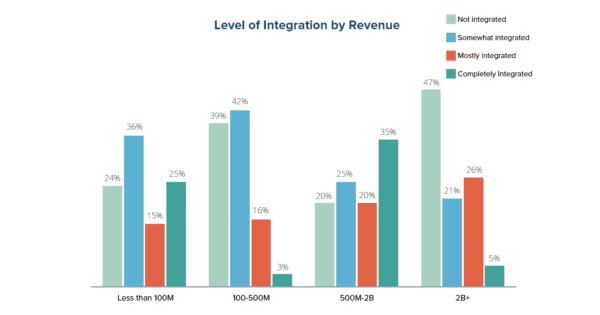

Levvel Research has found that the size of a company has a great effect on whether or not their purchasing and payables departments are integrated, see Figure 2. The revenue segment that is most likely to have completely integrated Procurement and Accounting departments includes those in the upper middle market ($500 million-$2 billion), followed by smaller organizations (less than $100 million). Levvel Research believes this is partly because both revenue segments hit something of a sweet spot. Smaller companies tend to operate under more consolidated processes naturally; some only have a handful of employees operating their back-office departments. Therefore, consolidation in simpler and less of a strain on their resources. Organizations in the upper middle market, on the other hand, are just large enough to have the resources for integration projects and just small enough that these projects do not cause great internal disruption. Companies in the upper middle market are also more likely to be using P2P automation software, which helps to streamline integration.

“How would you describe the process flow between Procurement, AP, and Payments?”

&

“What is your organization’s annual revenue in the most recent 12-month reporting period?”

Organizations with more than $2 billion in revenue are least likely to have integrated departments. This can be attributed to the great deal of effort such projects would require, including restructuring processes across multiple divisions and locations, and consolidating the numerous technical systems on which large organizations typically operate.

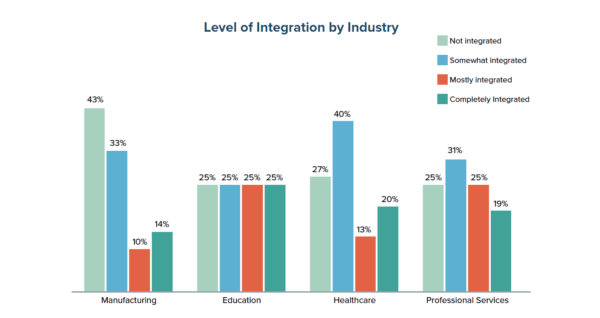

Industry also plays a role in an organization’s purchasing and payables integration, see Figure 3. Manufacturing and healthcare organizations report the highest rates of completely segregated departments, which can be attributed to the widespread nature of their operations, the complicated supply chain environments in which they operate, and the higher amount of direct spend—particularly for manufacturing. In addition, both industries have been historically slow to adopt finance technology and are more likely to have completely manual back-office departments, which slows integration initiatives. On the other hand, education and professional services are both leading industries when it comes to technology adoption, as they both tend to have more straightforward P2P processes with lower amounts of direct spend.

“How would you describe the process flow between Procurement, AP, and Payments?”

&

“Please select the standard industry description that best fits your organization.”

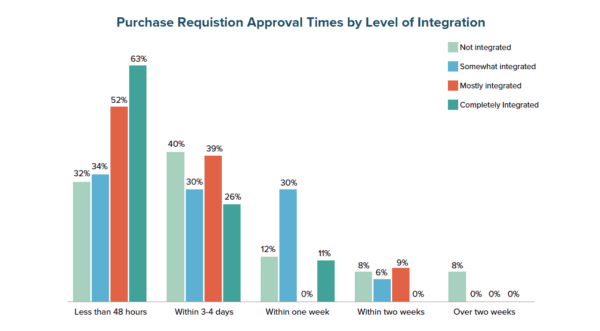

An additional major benefit of integrating Procurement and AP is the increased efficiency it brings. For example, Figure 4 shows that the amount of integration organizations have between their Procurement and Payables departments has a direct effect on how quickly they are able to approve purchase requisitions. In this survey, there were no companies with completely integrated departments that reported requisition approval times as more than one week. These short approval times help to condense the entire invoice-to-payment lifecycle, and can lead to millions of dollars in annual savings in both lower processing costs and early-payment discount capture.

“How would you describe the process flow between Procurement, AP, and Payments?”

&

“What is your organization’s average requisition approval time?”

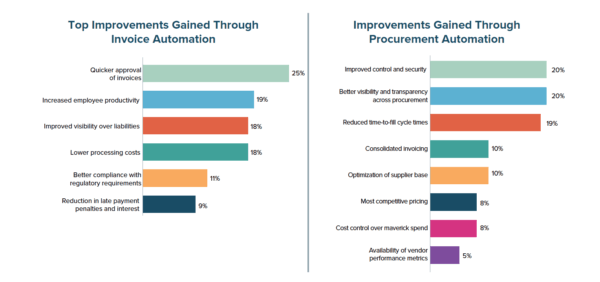

Companies can also improve efficiency by automating their Procurement and AP departments. P2P software creates a wide range of process improvements, including lower processing costs and increased control and visibility into spend, see Figures 5 and 6.

“Which of the following improvements have you seen in your procurement process since implementing a solution?”

&

“Which of the following improvements have you seen in your invoice management process”

When companies leverage P2P software and integrate their P2P processes simultaneously, they are better able to achieve scalable, streamlined, and low-risk integration. The following section further explores the role P2P automation plays in Procurement and Payables consolidation.

A P2P software suite typically includes automation for the entire back-office lifecycle of requisitioning, purchasing, receiving, invoice management, and payments. Today’s P2P solutions create an open and collaborative environment in back-office departments, allowing Procurement and AP managers to maintain consistent communication with staff, suppliers, and the company’s stakeholders in real time. They improve employees’ productivity, reduce time spent on non-value added tasks, and enable executive members of an organization to strategically manage spend. P2P software also unites different teams and visions, giving all parties visibility into spend management activity without sacrificing different members’ control. A P2P solution is one of the best ways to build enthusiasm for an integration initiative and ensure its success.

The following items showcase some of the features of P2P solutions, as well as how an organization can use P2P software to help streamline integration. P2P software:

The solution’s integration tools make it easy to plug the system into even the most complicated IT infrastructure. Many software providers also have teams of integration specialists to help IT configuration during implementation, as well as process reengineering consultants to help structure current operations around more efficient, technology-based processes. In all, P2P software allows companies to combine their departments much more easily across their complex current state.

P2P software’s consolidation benefits also improve data sharing across different roles. Under a separate system, Procurement and AP professionals must track each other down for certain information housed in separate places, such as an original purchase requisition for an invoice or a history of past supplier payments. With a P2P solution, access to information can be made available to anyone with the proper authority, and a request for information beyond their access is as simple as a direct message.

The list below contains a few best practices for professionals pushing for purchasing and payables integration in their organization.

As previously stated, fear of change can create a lot of resistance to an integration initiative and undermine its success. To prevent potential problems, a Procurement and AP department integration should be acknowledged and openly discussed whenever possible. Those pushing for integration should bring all stakeholders to the table, even those in lower positions in the company. While employees in a procurement requestor or AP clerk role may not necessarily have a final say in the decision to integrate, their enthusiasm for an initiative can add strength to a push for integration.

Even though all voices are important, it is still ultimately up to the C-suite to agree to and begin an integration initiative. Those pushing for integration can gain their enthusiasm and support in several ways. The first is to build a business case that includes a current state assessment and an estimate of improvements and savings possible with integration. Practitioners presenting the business case should also highlight the value of integration as it benefits the C-suite directly. One major benefit is the increased visibility into spend data the C-suite will achieve with integrated departments, which will enable them to make

more strategic financial decisions. Practitioners should also present improvements possible with P2P software adoption. They can do so with return on investment (ROI) assessment tools, such as those found in Levvel Research’s recent Pitching ROI for Accounts Payable report.

It is important to gather feedback from all parties on how the initiative would affect them; this feedback can be used to build out and adjust the integration plan. It is often the case that the C-suite has little insight into the day-to-day challenges experienced by P2P professionals, and all parties and voices should be considered and valued in order for an integration initiative to be successful. Organizations should also encourage new attitudes among employees in regard to how

they perceive and approach integration. They can do this by properly educating their workforce on how integrated processes will make their jobs more enjoyable.

This involves readjusting a variety of processes and strategies, including workflows, management approaches, and communication techniques. It also entails adjusting staff behavior by changing current methodologies that are not as efficient as possible and adjusting how employees interact with each other, especially considering the different mindsets typically found across the two departments. Practitioners should try to identify any current state problems early on, during their initial interviews with different parties. This way, they can turn the problems into goals and pitch them along with the initial integration project.

It is especially important to identify current state issues if an organization plans to implement P2P software during their integration project. A P2P solution is only as effective as the processes it integrates; when an organization’s Procurement and Payables departments are dysfunctional, they will not be able to get the most out of their solution.

Organizations do not have to begin a complicated integration initiative alone—they can seek help from the experts. Levvel Research offers several consulting services that benefit back-office integration, including current state assessments, recommendations for improvement, process reengineering, and software selection. For more information, visit Levvel Research’s consulting webpage.

Organizations hoping to leverage P2P automation in their integration initiative should consider the solution provider’s experience. This means finding a provider that has previously worked with companies to integrate their back-office departments and has support options in place to help clients streamline this process. For example, during

implementation some providers offer special integration experts dedicated to helping clients reengineer their current P2P process flows. The provider should also be able to help realign existing processes according to the client’s unique business requirements, including across different systems and locations.

The following profile highlights the features of a leading Procure-to-Pay provider. This provider has a track record of helping clients create a more integrated and streamlined P2P process in their back office.

PairSoft develops, sells, and supports advanced web-based and mobile requisition, procurement, accounts payable, and expense solutions for mid-market and enterprise organizations across a range of industries worldwide. PairSoft Payments provides enterprise users with the option of adding automated ACH payments within the PairSoft Spend Management solution for a fully centralized standalone P2P platform. The user interface offers flexible P2P automation and robust expense reporting that is easy for employees, effective for management, and powerful for accounting.

Many organizations start with manual receipt handling, fragmented card feeds and slow AP processes. Implement AI agents to auto-capture receipts, route approvals, enable punch-out buys and post to the ERP.

Result: faster batching, fewer errors and cost savings. “This saves us hours every month.”

Many organizations face slow, paper-heavy AP and fragmented procurement that waste time and inflate costs. AI Agents can automate approvals, PO matching and record sync to improve speed, accuracy and control. Client quote: “It freed up hours and made our process reliable.”

Operational drag and rising costs slow growth: teams waste time on manual tasks, misaligned priorities and opaque processes. AI Agents help automate routine work and coordinate actions across teams. “We’ve lost time to repeats and handoffs,” says a typical client.

Companies struggle with manual procurement, fragmented approvals, and costly integrations that slow growth and obscure spend. Our AI Agents streamline requisitions, POs, and invoice matching to cut manual work and improve visibility. “We were wasting time and missing insights,” says a client.

Many teams start with fragmented PO/AP systems, manual matching and delayed financial reporting. Deploying AI agents to automate PO checks, real-time encumbrance tracking and invoice matching reduces processing time and errors, delivering live budgets and faster closes. “Finally, we can see current balances and approve instantly.”

Many companies juggle growing invoice volumes and legacy systems. They struggle with manual processes, compliance gaps and limited headcount. Our AI Agents automate integrations, enforce rules and surface exceptions. The typical outcome: faster closes and measurable ROI. “We stopped chasing invoices.”