If someone were to ask you that as it relates to your company, would you know them offhand? Would you need a week to check with your accounts payable team and circle back? Would KPIs even apply to your business model?

There’s no one-size-fits-all metrics package, but there are common denominators among high-performing organizations that inform their best decisions and biggest growth. We’ve done a deeper dive into how Key Performance Indicators can influence the trajectory of your business, but we want to provide a snapshot of our top five, too, so that you can see how closely you align — or start planning how you’d like to get there.

- Invoice Cycle Times

This is almost always the top challenge we hear within the AP and procurement industry: that companies don’t know how to improve their time consumption when it comes to the invoice lifecycle. For reference, it takes small-to-midsize companies an average of 25 days to process a single invoice. For high performers using automation software, it takes just 3.Technically, it’s not the number of days that matters here — it’s what’s causing the time consumption, whether we’re talking unnecessary workflows, hold-ups with payment, or exception processes that need to be altered. This KPI is incredibly important because it’s a symptom identifier rather than a cure-all.

- Invoice Approval Times

In a similar vein, approval times within the invoice lifecycle are measured to catch repeated bottlenecks. If invoices are continuously paused at certain vendors and approvers, though they speed up with others, what does that say about where your time and money are being spent? It’s best to keep this metric separate from the overall cycle time to nail down best practices as far as stakeholder relationships go.

- Payment Error Rates

When you’re tracking your payment error rates, you’re essentially tracking the most important part of your business: whatever’s going on with your money. Payment errors happen for several reasons — sometimes due to duplicate or incorrect information — but they typically happen when a payment is being made by check. Which can be problematic, considering that 45% of businesses make more than half of their payments via check.This can really boost the number of mistakes being made among the most crucial element of a company’s survival, but it can be remedied by both the measurement of error rates as well as subsequent solutions such as payment automation and electronic payment methods.

- Number of Invoices Per FTE

The average AP manager can process 5 invoices per hour, whereas an automated solution can churn through 30. That fractional difference is all that needs to be said about this KPI’s efficacy when it comes to time budgeting — after all, how many more complex issues could an AP manager be focusing on per hour if they’re not tied up with manual invoice processing?

- Cost Per Invoice

OK, it’s a tough sell to call this the most important KPI after listing four other important ones, but it really does come down to what’s driving your costs. The average cost to manually process an invoice ranges between $14-$30, whereas automation once again reigns with an average of $7 for that same process.And the thing is, this isn’t covering just the invoice. We’re talking about the time, the technology, and the manual steps that needlessly drive that dollar amount upward. So, knowing this amount ultimately means knowing a pressure point of your cashflow, how robust your workflow is, and how much human intervention you’re expending that could be better spent elsewhere.

These five KPIs work hand in hand to improve your visibility into your AP process while ensuring that you can keep that view as you evolve in months and years to come.

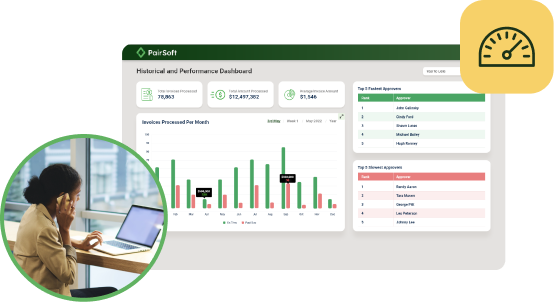

Not sure where to start on measuring, or need more insight as to how your specific industry sets its benchmarks? Check out our more in-depth report on essential KPIs, or get in touch to learn how our analytics dashboard can get you up to speed.

Why settle for low performance?

Get a free demo to learn how our tailored workflows have boosted the financial performance for organizations of all sizes.