Salim Khalife

Salim Khalife founded Paramount Workplace, now a subsidiary of PairSoft. He currently uses his decades of SaaS experience in the consulting space and is based out of Michigan with his family.

View all posts by Salim KhalifeSalim Khalife • August 8, 2023

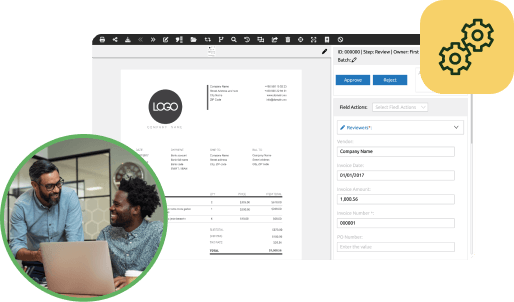

Accounts payable automation involves leveraging technology to streamline and optimize the traditionally manual tasks associated with managing supplier invoices, approvals, and payments. By automating these processes with APIs through your ERP, organizations can drastically reduce the risk of errors, enhance data accuracy, accelerate processing times, and ultimately improve overall financial control for the relatively reasonable pricing of SaaS technology.

While the concept of automation is not new, recent advancements in artificial intelligence (AI) and machine learning have brought about a new level of sophistication to AP automation solutions such as invoice and payment processing. These modern tools can handle complex tasks such as data extraction, invoice matching, coding, and even decision-making, previously only achievable through human intervention.

Sage Intacct is a leading cloud-based financial management system that empowers organizations with real-time financial visibility, flexibility, and scalability. When integrated with an intelligent accounts payable automation solution, Sage Intacct customers can unlock a multitude of benefits:

Manual data entry is prone to errors, which can lead to costly discrepancies and reconciliation challenges. AP automation eliminates the need for manual intervention, significantly reducing the risk of human errors through optical character recognition (OCR). Data is accurately extracted, validated, and recorded, ensuring that your financial records are always up to date and error-free.

The manual processes in AP involve multiple touchpoints, from invoice receipt to approval and payment. With invoice automation, these steps are streamlined, accelerating the entire process. Invoices are automatically captured, validated against purchase orders and contracts, and routed for approval based on predefined workflows. This eliminates bottlenecks and reduces processing times, allowing your finance team to focus on more strategic tasks.

Compliance with financial regulations and internal controls is crucial for businesses of all sizes. AP automation enforces consistent approval processes and provides an auditable trail of all activities. This level of transparency ensures that financial operations adhere to compliance standards, reducing the risk of fraud and non-compliance penalties.

Automating routine AP tasks frees up your finance team’s valuable time, enabling them to focus on strategic initiatives. With accurate and timely financial data at your fingertips, you can make informed decisions that drive business growth and profitability. Sage Intacct’s reporting capabilities combined with AP automation insights provide a comprehensive view of your organization’s financial health.

Efficient AP processes contribute to stronger supplier relationships. Timely payments and accurate invoicing create a positive rapport with suppliers, potentially leading to more favorable terms and conditions. With automated AP, you can take advantage of early payment discounts and negotiate better deals, ultimately optimizing your cash flow.

Integrating AP automation software with Sage Intacct is a strategic move that requires careful planning and execution. Here’s a step-by-step guide to help you get started:

Before implementing automation, evaluate your existing AP processes. Identify pain points, bottlenecks, and areas where automation can bring the most significant benefits. This assessment will guide your automation strategy.

Select an AP automation solution that seamlessly integrates with Sage Intacct. Look for features such as data extraction, intelligent routing, invoice processing, approval workflows, and analytics. Ensure that the solution aligns with your organization’s (and your CFO’s) needs and goals.

Map out your ideal AP workflows and approval hierarchies. Configure the automation solution to match your organization’s processes and business rules. This step is crucial to ensure a smooth transition to automated processes.

Migrate historical AP data into Sage Intacct and the automation solution, ensuring data consistency and accuracy. Set up integration between the two systems to facilitate seamless data flow.

Provide comprehensive training to your finance team and stakeholders on using the AP automation solution and its integration with Sage Intacct. Emphasize the benefits and address any concerns to facilitate smooth adoption.

After implementation, continuously monitor the performance of your AP automation solution. Analyze key metrics, gather feedback, and identify areas for improvement. Regularly update workflows and rules to accommodate changing business needs.

Accounts payable automation, when seamlessly integrated with Sage Intacct, can propel your organization toward greater efficiency, accuracy, and strategic financial management. By eliminating manual tasks, reducing errors, and enhancing control, you empower your finance team to focus on driving growth and making informed decisions. As technology continues to advance, embracing AP automation management software becomes a strategic imperative for modern businesses seeking to stay competitive and agile in an ever-evolving marketplace.

Are you looking to automate your accounts payable process with a major ERP? Get a free demo today to learn how PairSoft can do all this and more, including payment automation.

Get a free demo to learn how our tailored workflows have boosted the AP performance for organizations of all sizes.