In today’s fast-paced digital world, where convenience and efficiency are paramount, traditional paper checks have become an outdated and risky method of payment. While they may have served as the backbone of financial transactions in the past, paper checks now pose numerous dangers that can jeopardize financial security and hamper business operations, as well as high processing costs and error-prone procedures. As technology continues to advance, the transition to accounts payable automation and a payment automation solution offers a safer, more reliable, and streamlined alternative. In this blog post, we’ll delve into the perils of using paper invoices and checks and highlight the compelling reasons to move your payment process into the digital world.

The Dangers of Paper Checks

- Fraud and Forgery: Paper checks are susceptible to payment fraud and forgery. Once a check is issued, it can be intercepted, altered, or duplicated, leading to unauthorized transactions. Criminals can manipulate the payee’s name, alter the amount, or even replicate the check, causing financial loss and reputational damage that is extremely minimized with automated payment systems.

- Delayed Payable Process: Paper checks require physical handling, mailing, and manual processing by both the payer and the payee. This can result in significant delays in funds availability, which can disrupt cash flow for businesses and cause inconvenience for individuals awaiting their payments on time.

- Human Error: Manual data entry and processing introduce the risk of human errors, such as incorrect account numbers, wrong amounts, or misinterpreted handwriting. These errors can lead to payment discrepancies, duplicate payments, late payments, strained supplier relationships, and the need for time-consuming rectifications.

- High Costs: The seemingly simple act of writing, printing, and mailing checks incurs hidden costs such as postage, envelopes, and administrative labor on the payable department. For businesses, these costs can add up quickly, eating into profit margins and diverting resources from more valuable tasks.

- Environmental Impact: The production of paper checks contributes to deforestation and carbon emissions. Additionally, the transportation involved in mailing checks further compounds the environmental footprint. As sustainability becomes a global concern, opting for a digital payment solution is a responsible choice.

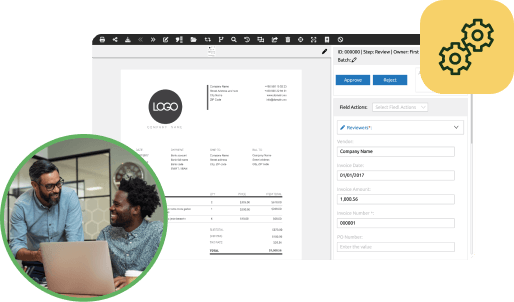

Embracing Payment Automation

- Enhanced Security: Payment automation systems employ advanced encryption and authentication protocols to ensure secure transactions. Multi-factor authentication and biometric verification add layers of protection that are virtually impossible to replicate with paper checks.

- Reduced Fraud Risk: AP automation solutions drastically reduce the risk of fraud and forgery. Automated systems use secure networks and real-time monitoring to detect suspicious activities, preventing unauthorized transactions to your bank account before they occur.

- Faster Processing: Automation software for B2B payments enables instant fund transfers and real-time processing through electronic payments like ACH payment or virtual card. Businesses can benefit from accelerated cash flow, leading to improved financial planning and reduced dependence on credit lines to cover gaps.

- Accuracy and Error Mitigation: Automated accounting systems eliminate the need for manual data entry, reducing the chances of human errors. Accurate payment information is seamlessly transferred, mitigating disputes and saving valuable time.

- Cost Savings: Transitioning to payment automation eliminates the costs associated with paper checks, such as printing, mailing, and administrative labor. Businesses can redirect these savings towards growth initiatives and innovation, allowing their AP departments to focus on more strategic projects.

- Environmental Responsibility: By embracing payment automation, you contribute to a greener planet by reducing paper consumption and carbon emissions associated with traditional check processing.

- Convenience: Automated payments can be scheduled and executed remotely, offering unparalleled convenience. Whether you’re an individual paying bills or a business disbursing salaries, the ability to manage transactions from anywhere at any time streamlines financial operations.

- Improved Vendor Relationships: Timely and accurate payments foster trust and strong relationships with vendors, suppliers, and customers. Reliable payments enhance your reputation and position you as a dependable partner in the marketplace.

The era of paper checks is rapidly fading as the dangers and inefficiencies associated with them become more evident. The digital age presents us with a plethora of payment automation options that offer enhanced security, streamlined operations, and a host of benefits that traditional checks simply cannot match. The transition to automated payment options is not only a logical step but also a responsible one, aligning with the demands of modernity and sustainability.

Whether you’re an individual seeking a more convenient way to manage personal finances or a business aiming to optimize cash flow and operational efficiency, payment automation is the solution. By embracing this technology, you’re not only protecting your financial interests but also contributing to a more secure, accurate, and environmentally conscious future. The time to leave paper checks behind and embrace payment automation is now.

If you’re bogged down by paper checks, now is the time to upgrade to a newer, more efficient payment method like PairSoft Pay. Get a demo today to learn more.

Why settle for low performance?

Get a free demo to learn how our tailored workflows have boosted the AP performance for organizations of all sizes.