The flow of donations in and out of a nonprofit, from solicitation to procurement to allocation, necessitates effective financial management. However, limited staff resources, combined with reliance on manual processes, can complicate the organization of financial records.

To overcome these obstacles, nonprofits need robust and cost-effective accounting tools and resources. This guide explores the top tools nonprofits should look for and the implications of implementing these resources.

3 Resources to Support Nonprofit Accounting

1. Accounts Payable (AP) Automation

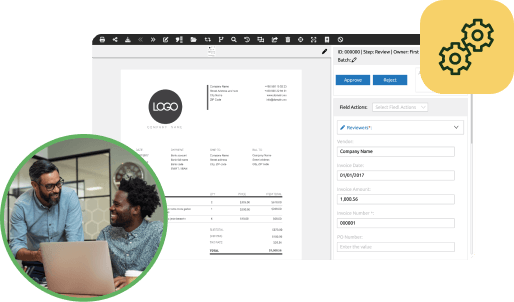

Automation not only streamlines accounts payable processing, but it can also ensure that proper internal controls are in place to help protect the organization’s assets. Your nonprofit can implement a document management system (DMS) to access automation tools. Their functions include:

- Invoice processing: Invoices are emailed to and entered into the web-based solution with the assistance of artificial intelligence (AI). This helps to ensure that invoices are properly recorded, categorized, and paid on time. It also allows for more reliable records by reducing the risk of errors that come with manual data collection and entry.

- Audit trails: The programs include a comprehensive audit trail that documents each person who touched the invoice on its journey from receipt to payment. This is a significant internal control that helps to reduce the risk of fraud and misappropriation. It streamlines compliance and enhances financial accountability.

- Purchase order management: As your team makes purchases and maintains inventories, generating purchase orders is vital for recording financial transactions. Automating this process allows for instant receipts and invoices as well as centralized document management to help track transactions more closely.

In addition to reducing errors and improving record-keeping accuracy, AP automation saves staff time that would be spent on repetitive manual tasks. This allows the organization to use its personnel more effectively and efficiently—they can be redirected to more mission-centric tasks instead of rote data entry.

2. Analysis of Financial Statements

As Chazin & Company explains, nonprofits must leverage analytics in financial management. Using analytics can uncover patterns and inconsistencies to:

- Enable informed decision-making

- Increase accuracy in financial reporting

- Improve budgeting

- Proactively detect potential financial issues, such as errors or fraud

As a result, your nonprofit can glean valuable insights from its data to help maintain its financial integrity and stability.

3. Outsourced Accounting Services

While your organization’s team is likely committed to keeping organized and accurate financial records, it may lack the in-house, unique accounting knowledge particular to nonprofits. Outsourcing these responsibilities to an external accounting firm provides access to the necessary professional expertise and benefits such as:

- Access to advanced accounting technology. Accounting professionals leverage software for bookkeeping, tax preparation, financial reporting, and other vital financial processes. By outsourcing your nonprofit’s accounting needs, your team can access the benefits of these advanced tools without the burden of navigating direct implementation yourself.

- Reduced burden on your staff. With accounting outsourced, your team members can focus on core mission activities. This improves overall organizational productivity by removing the need for financial training and the ongoing accounting requirements to maintain organized records.

- Assurance of compliance and accuracy. Outsourced accounting adds a much-needed layer of internal controls to your organization’s financial health. An expert with experience in nonprofit finances will be familiar with the relevant accounting techniques and requirements.

Outsourced accounting is both effective and efficient, and it can be more cost-effective than maintaining an in-house accounting team. You’ll gain access to high-quality services without the cost of a full-time staff. Additionally, professional accountants often offer a flexible pricing plan that allows your organization to scale services based on its evolving needs.

How to Implement Accounting Tools

While there are various accounting resources available to nonprofits, knowing which ones to leverage and how to implement them is essential to ensure a smooth transition between workflows. The process should involve the following steps:

- Assess your organization’s specific accounting needs. Analyze your current accounting approach to identify any inefficiencies. For instance, if you recognize a need to improve your AP workflow, plan to research automation tools.

- Select the right accounting tools or services. Conduct research to identify the technology or services that would most benefit your nonprofit. Narrow down your options by comparing the benefits of each and exploring client testimonials to learn about the experiences of others.

- Train staff on how to use new resources. Introduce new accounting resources to relevant team members and explain their role in interacting with these tools or services. In practice, this could range from explaining how to track in-kind donations to hosting a walkthrough of a newly implemented solution.

- Continuously monitor the effectiveness of your accounting tools. As time passes, gather feedback from team members to measure their satisfaction with your new accounting processes. Establish relevant key performance indicators (KPIs) to gauge fluctuations in effectiveness over time.

To maximize efficiency, establish a routine for periodic reviews of your financial processes. This can help your team identify areas for improvement as you implement new tools and resolve any potential problems in a timely manner.

The benefits your organization may experience from organized and accurate financial records are countless. Ultimately they impact your stakeholders and their trust in your operations.

As eCardWidget explains, sharing details about the way your nonprofit uses donors’ contributions can build trust among supporters and reassure them that your organization will do the work you claim to do. These impact reports, along with streamlined internal processes and increased productivity, are made possible only by financial records based on solid accounting practices.