Janet Martin

Janet joined the PairSoft team upon its merger with Paramount Workplace, where she was also an integral part of the sales team for years. Janet resides in Michigan with her family.

View all posts by Janet MartinJanet Martin

Q4 2017 | Featuring insights on:

When it comes to exploring the benefits of an automated Accounts Payable (AP) process over a manual AP process, the case is fairly straightforward. Manual AP causes high processing costs, slow invoice approval times, frequent missed payments, weakened supplier relationships, and overall inefficient use of company resources. On the other hand, automated AP reduces processing costs, lowers the number of missed payments, raises a company’s internal and external efficiency, and improves its bottom line. However, while there are millions of dollars’ worth of annual savings in the gap between a manual and automated AP process, many companies leave those savings on the table. Levvel Research believes that this is because not every company is able to find the right solution for their AP needs.

AP automation is a general term that is used to encompass what is often a very complex process. It is true that for some companies, such as a small business with only a few hundred invoices a year, an automated AP state is a relatively simple thing to define, map out, and achieve. But for larger companies with tens of thousands of invoices a year, a large supplier base, and a complicated business structure, automated AP is much more difficult to imagine, much less attempt. These companies have numerous and complicated requirements for properly conducting invoice verification, validation, reviews, approvals, and payment. The complicated nature of their current state causes many companies to make excuses to avoid adopting invoice management automation software. They believe they are managing their own processes in a satisfactory way, and that the time, investment, and disruption involved in a software implementation would not be worth the risk.

Fortunately, software is available that is flexible and powerful enough to meet the needs of even the most complicated invoice management lifecycles. Invoice workflow automation (IWA) software is built to digitally manage an invoice throughout its lifecycle while offering flexibility and visibility. The solution can adjust to an AP department’s unique needs rather than forcing them to conform to the solution’s capabilities. IWA software can also be implemented without major disruption to the current state, with ROI that is easy to predict and quick to achieve. This report explores leading AP automation solutions that offer advanced invoice workflow approval capabilities.

In order to identify invoice management trends among North American organizations, Levvel Research surveyed over 400 back-office employees across several industries and market segments. The following data is taken from Levvel Research’s recent AP management survey.

The first step in the invoice management workflow—and often one of the greatest pain points—is invoice receipt. Trouble arises when companies receive the majority of their invoices outside of a centralized, digital system. The greatest examples of inefficient receipt types are paper, fax, and email invoices, although email is preferred to the first two types. The most efficient invoice types are electronic invoices (eInvoices) or those in EDI/XML format, and invoices submitted through a web-based, AP solution portal. Unfortunately, Levvel Research’s survey results show that for most AP departments, paper and email are the top two formats in which invoices are received, see Figure 1. However, results also show that if a company is using an AP automation software, it is more likely to be receiving invoices in digital formats.

Figure 2: Most Companies Receive the Majority of their Invoices in Paper and Email Format

“Please allocate 100 percentage points on how your organization receives invoices.”

The movement and workflow of an invoice after receipt typically varies based on the way the company has structured its AP department and processes. Research also shows that about half of organizations have a fully centralized AP department, while 10 percent have completely decentralized departments, see Figure 2.

Figure 2: Half of Organizations Have Centralized AP Departments

“Which statement best describes your invoice receipt and payment process?”

The structure of an organization’s AP process varies based on its size, see Figure 3. SMEs1 have the highest rate of centralized AP departments, as the lower number of invoices and spend in these companies makes it easier for them to receive and pay all invoices in one location. Organizations at the enterprise and UMM levels are somewhat less likely to be completely centralized than SMEs, but they are more likely to have partly centralized processes, where invoices are received at different offices but are paid by one entity. This is likely because larger-revenue organizations often have more resources and controls in place for managing back-office processes across widespread operations. In contrast, LMM organizations are most likely to have decentralized processes. This may be because their processes tend to rest between those in other market segments—they do not quite have the simplified AP state of SMEs or the resources for controlled processes of larger companies.

Figure 3: Organization Size Plays a Role in Whether or Not an AP Process is Centralized

“Which statement best describes your invoice receipt and payment process?”

&

“What is your organization’s annual revenue in the most recent 12-month reporting period?”

Invoice format, centralization, and company size are all factors that affect the workflow of an invoice within an organization after it is received, as well as the efficiency of that workflow. The invoice workflow can entail a complex and varied set of actions, including multiple levels of approvals, different rules relating to different types of invoices, and a large number of “touches” (points at which the invoice is reviewed or passed on at any point). Within the invoice lifecycle, many things can go wrong, and the less AP automation and centralization a company has achieved, the more issues arise. Research shows that today’s AP departments’ most common issues in invoice management are manual data entry and inefficient processes, manual routing of invoices, and high volumes of paper invoices, see Figure 4

Figure 4: Most Hospitality Organizations Want Improvements in Data, Cost and Supplier Control, and Spend Visibility

“In what area would you like to see the greatest improvements in your procurement process?”

There were some variations in pain points across different revenue segments. SMEs’ problems are relatively straightforward—they report high volumes of paper invoices as their biggest pain point. However, as company revenues grow, the problems become more logistical. Both LMM and UMM companies report more issues related to invoice lifecycle management—such as inefficient data entry, routing issues, decentralized invoice receipt, and lost or missing invoices. Enterprises ranked a high number of discrepancies and exceptions as one of their highest pain points, which is likely caused by difficulty managing a large amount of data.

As many organizations’ AP process issues result from manual-related methods, one way to reduce these issues is to automate invoice management. Many companies have automated or have moved to automate their invoice workflow process, and adoption/interest has grown steadily over the last few years, see Figure 5. However, 30 percent of respondents still are not using an IWA solution.

Figure 5: Over Half of Organizations are Using or Planning to Use an Invoice Management Solution

“Are you currently using or planning to implement an automated workflow solution in the next 12

Some industries are more likely to implement an invoice workflow automation solution than others. For example, only 22 percent of education respondents report using an IWA solution, whereas 60 percent of finance/banking/insurance respondents have adopted an IWA software, see Figure 6.

Figure 6: Finance-Focused Industries Are Leaders in Invoice Automation Adoption

“Are you currently using or planning to implement an automated workflow solution in the next 12 months?”

&

“Please select the standard industry description that best fits your organization.”

Levvel Research has found that the companies in finance/banking/insurance industries have historically been more progressive when it comes to back-office automation, and AP software is no exception. On the other hand, education organizations are often behind when it comes to automating their financial processes, even though these companies typically have widespread operations that would benefit from a centralized and automated invoice management process.

Unfortunately, even though many organizations would benefit from automation, they are often unwilling or unable to adopt a tool. Figure 7 shows the most common barriers to IWA software adoption. For most companies, it is a lack of budget or the belief that current processes are working that prevent them from automating. For companies in the UMM and LMM, a lack of budget and a fear that there will be no ROI are their largest concerns, while enterprise companies’ belief that current processes are working and fear of little ROI are the biggest barriers to adoption.

Figure 7: Organizations Do Not Adopt Because of a Lack of Budget and a Belief that Current Processes Are Working

“What is your organization’s annual revenue in the most recent 12-month reporting period?”

One of the ways to overcome adoption barriers is to educate top decision-makers on the benefits of IWA automation. Research shows that companies that adopt these solutions gain improvements in invoice approvals, employee productivity, and processing costs, see Figure 8. All these benefits can help to improve the bottom line and bring an ROI. Another way to show the value of AP automation is to use ROI calculators that help to estimate the monetary value of adopting an AP solution. Readers can access these calculators in Levvel Research’s recent Pitching ROI report.

Figure 8: Most Organizations Achieve Improvements in Approval Times, Employee Productivity, and Processing Costs with IWA Software

“What benefits have you achieved since adopting an IWA solution in your organization?”

In order to educate organizations on the use case and value of automation for the AP process itself, the following section details the features, services, and benefits of IWA software.

An advanced IWA solution is designed to adapt to existing business structures, diverse supplier bases, and complicated approval hierarchies. In order to meet these requirements, the software must address the entire invoice lifecycle and be highly advanced, customizable, and versatile.

Before an approval workflow solution can operate successfully, invoices must be entered into the organization’s system in an efficient, timely, and accurate manner. There are two primary ways to input invoices into a workflow system electronically—through the use of a scanning and Optical Character Recognition (OCR) data capture process or via an eInvoicing network.

Optical Character Recognition (OCR) is the electronic conversion of scanned images or text to a machine-encoded document. OCR extracts the relevant data from scanned paper or PDF invoices and sends it through validation and routing. OCR technology can be used in several invoice receipt methods, including mailroom services, email extraction, and online portals.

After invoice data is extracted, the OCR-converted documents are verified against a set of validation rules; the solution compares specific fields against the information held in the appropriate back-end system (e.g., purchase order numbers against the purchasing system). Validation technology is a second round of checks and balances for invoice consistency and compliance—after the initial capture of data, it re-affirms the integrity of business documents before they are assimilated into the main workflow system.

The use of advanced OCR technology ensures a high level of precision, consistency, and compliance. Advanced OCR technology provides capture capabilities that have excellent pass-through rates when scanning paper documents, and some technologies can also extract data from the subject and body of emails, rather than from the attachments only. Some technologies can also read and extract data in several different languages. In all, the more advanced the OCR software, the more streamlined the routing process becomes down the line.

Electronic invoicing eliminates all manual data entry by the buyer. There are three methods of electronic invoicing:

Advanced eInvoicing solutions are free for suppliers, and many feature advanced global capabilities for complex invoice requirements in Europe, Asia, and Latin America. The greatest advantage of eInvoicing is the ability to send invoices straight to the approver and then straight to payment (i.e., straight-through processing).

Workflow solutions enable AP departments to define how different types of invoices are processed. Invoice matching and routing involves linking invoices to purchase orders and other receiving documents, then sending them through the appropriate approval chain based on terms identified within the invoice (such as PO number). PO-based invoices can be matched against PO and receipt documents automatically, while non-PO invoices are routed to the appropriate approvers.

All invoices are routed based on predefined business rules, and user roles and access rights can be set to match the organization’s existing approval hierarchy. Many solutions give client administrators control over individual user access rights. Those administrators can then delegate the types of approvals for each employee, their level of visibility, and their authorized dollar thresholds.

Advanced technologies provide field-level matching, meaning that they match specific characters in invoice line items with their counterparts in POs. Some solutions create notifications or workflows driven by fields with invalid or missing data, and some feature the ability to dictate workflows for non-PO invoices based on invoice contents.

Users may also assign non-PO invoices to categories within the general ledger, and advanced solutions allow specific line items to be assigned to multiple cost centers or multiple POs.

The accuracy of rules-based matching engines, in combination with eInvoicing, allows many companies to automatically pay invoices that meet all validation rules shortly after receipt, letting AP staff focus only on exceptions. This pass-through feature can be used for low-value or recurring invoices (such as utility bills).

Invoices that fail validation and matching undergo a pre-established workflow and routing procedure also called exception management. Invoice exceptions could be a discrepancy between an invoice and a PO or missing information such as PO number, approver’s name, or location code. The exception management process lets users re-route invoices and fix errors by viewing the original invoice to identify handwritten, printer, or OCR errors. Advanced exception management software allows for the creation of custom workflows depending on the type of exception present. These solutions also enable users to set thresholds for non-PO invoices to identify potential errors or fraud, such as an invoice for snowplow services in July. In addition, many systems put the responsibility of exception and discrepancy resolution back on suppliers, returning the document to them for correction before allowing it to enter the main workflow system.

Once invoices have been validated, matched, and routed into the appropriate queue, a variety of approval workflow capabilities ensure that those invoices are approved in a timely manner. Most invoice workflow solutions are highly configurable; they are built to adapt to an organization’s existing approval hierarchies and enable more complex routing (e.g., among different departments and cost centers). During and after initial setup of a solution, organizations can easily adjust workflows according to their own business rules, legal requirements, and the invoice type, amount, or other content. Advanced solutions facilitate this customization through visual workflow editors with detailed process flows and drag-and-drop functionality.

When invoices require review, approvers can typically be notified via email or mobile alerts. Most solutions come bundled with alerts and reminders for approvers, out-of-office delegation rules, and escalation procedures for overdue invoices. Prioritization capabilities allow organizations to move invoices with early payment discounts to the top of the processing queue, ensuring that they are approved in a timely manner. In addition, some solutions feature workload-balancing features that redistribute the invoices in an approver’s queue to different employees if that approver’s workload exceeds a certain number of invoices.

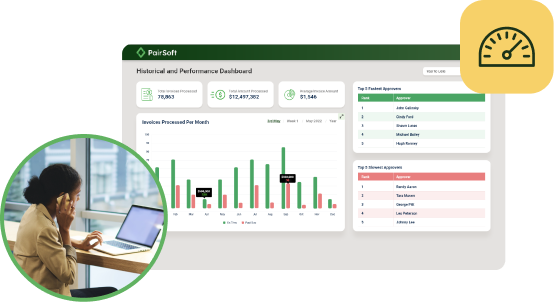

AP interfaces make approvals easier and more transparent. Dashboards allow users to navigate in-progress invoices, providing complete histories of the documents. Supervisors can track the status of individual invoices or approvers, reorganize and prioritize unapproved invoices, and access audit trails at any time.

Some solutions offer approval capability directly from within emailed notifications; in other situations, users can click on a hyperlink in the email and log in to a system to view, code, and approve invoices online. Many solutions also offer mobile approval capability through native and/or responsive web-based apps. Offering multiple methods for approval keeps invoices moving through the system when approvers are on the go.

IWA solutions greatly improve approval times through intelligent invoice routing and workflows, and through approval reminders and escalations. AP managers can also easily customize business rules and approval routes to separate high-priority invoices, such as those from a special supplier, ensuring that they are pushed to the top of approval queues.

After an invoice has been approved, it is automatically sent forward to payment. Basic solutions create a payment file that is sent to the ERP (which then initiates payment or sends a message to AP). These solutions also facilitate the input of ACH information and integration with back-end AR systems.

To completely automate the invoice lifecycle, some solution providers offer an in-house or partner-provided electronic payments solution. For advanced solutions, this entails integration with virtual card solutions and active supplier onboarding services. Some solution providers even cut checks on behalf of the buyer if they fail to onboard suppliers to virtual cards or ACH.

Some IWA providers offer a web-pay portal for vendors to log in and view invoice and payment transaction status in real time. These portals can also support different payment types and automatic formatting of remittance information based on supplier preferences.

Most IWA solutions combine process transparency with robust reporting and analytics tools, greatly improving an organization’s ability to audit, analyze, and improve procedures. Reports can be exported as spreadsheets and can include first-pass success rates, exception rates, and open invoices for any defined period of time. Some solutions feature internal benchmarking, allowing users to review how their organization compares to other end-users of the solution. Leading solutions offer a drag-and-drop report building functionality and exceptional drill-down capabilities from within a reporting dashboard.

Many IWA systems also offer sophisticated invoice and payment audit technologies. Audit solutions can integrate seamlessly with numerous accounting applications and can flag potential duplicates. Clients have the option of configuring the business logic that will be applied to identify erroneous payments, and the solutions generate reports on a periodic basis highlighting potential payment errors for resolution.

One way to ensure the success of an AP automation initiative is to gain suppliers’ enthusiasm and ensure their participation in the solution. Many IWA software providers proactively engage their clients’ supplier communities in order to gain as much participation in the invoice management platform as possible. Some providers run large-scale onboarding campaigns, reaching out to suppliers via phone, email, and/or mail with invitations to join their network. These provider onboarding teams may also help the buying organization create invitation templates for its own outreach campaigns, as well as help configure registration landing pages on the organization’s website.

Suppliers are also more likely to participate in automation when the solution is supplier-focused—many of these tools offer valuable supplier self-service capabilities that speed up and streamline invoice processing. Supplier portals allow suppliers to upload invoices, check on the status of invoices, and communicate with buyers about exceptions and errors. Some solutions permit buyers to create custom business rules at the point of supplier portal invoice upload. These rules create instant error notifications and allow PO flip from within the portal. Some solutions also enable suppliers to input payment preferences, upload payment information, and verify payment information in real time. These portals also facilitate better supplier-buyer communication and dispute resolution.

Some IWA solutions give organizations access to working capital management tools such as dynamic discounting, supply chain financing, and electronic payments such as virtual cards. These tools all increase companies’ savings and bottom line, either through sliding scale discounts, third-party financing, or payment rebates. Moreover, working capital management tools benefit the supplier through fast invoice payments, thus improving business relationships.

Leading AP automation solutions provide their clients with dynamic mobile applications, allowing users to access business software tools from anywhere, at any time. Mobile access includes invoice verification and approvals, as well as communication with suppliers on invoices and payments. These applications are typically available through a responsive web app or a native application for mobile operating systems.

In order to successfully choose and implement an invoice workflow solution, organizations should properly map out their current state. This means understanding the typical and atypical lifecycles of its invoices—all the elements that go into the fulfillment of an invoice, such as supplier characteristics, approval routing scenarios, budgets, and reporting requirements. Organizations should map out their current state for two reasons: first, they can use this detailed map to identify areas of improvement in current processes; second, they can use the map to help select the right invoice workflow automation provider.

Below is a set of questions companies can use to help map out their current invoice management state and prepare for an improved future state.

| Question | Relevance |

|---|---|

| How many invoices a year does the organization process? How many of each type? | This contributes to the current state analysis. Organizations should make sure they identify the overall number of invoices and number by each type (spend type, local vs. global, based on priority, utility vs. goods, etc.). This will help create a map that shows where invoices go—and ensure the solution provider can handle the invoice volume and different types. |

| What are the percentages of invoice receipt types? | This entails segmenting the current number of invoices by paper, EDI, fax, email, and web portal receipt type. This will help the organization identify where they should start with automation, as the volume of different types may affect which provider the organization chooses. For example, a company with high volumes of paper may opt for a provider that offers mailroom services so that they can slowly phase their suppliers into more digital methods without disrupting the status quo too rapidly. Another company may receive the majority of their invoices in email format and will have much less trouble onboarding their suppliers onto an eInvoicing network or pushing them to submit invoices via a web-based portal with a built-in data capture tool. |

| How many suppliers does the organization have? | This requires the organization to separate their suppliers by type (relationship length, priority based on spend, geographic location, etc.). This is also a good opportunity to identify which suppliers are sending the majority of paper invoices and to build out an onboarding strategy based on that and other supplier-related parameters. |

| How many official AP approvers are responsible for invoice review and approvals? | This will help the organization identify what type of workflow tool they will need, and how to configure role-based access. It may also help the organization identify inefficient or redundant approval patterns that can be restructured. Identifying all AP touches will be very important when it comes time to build out validation and approval workflows for invoices during implementation. |

| How many touches outside of AP are typically involved per invoice? | Some companies, particularly those in the middle market, take many purchases outside of centralized procurement departments and therefore require a more widespread set of reviews and approvals on PO-based invoices. In this case, the organization can look for a solution that offers a versatile, accessible, and controlled collaboration platform for non-AP users. |

| Is the organization’s AP process centralized, decentralized, or somewhere in the middle? Does the organization plan to centralize AP? | If the organization has a very decentralized AP process and no immediate plans to change that structure, the organization should identify a solution that can accommodate that structure without sacrificing control. |

| Does the organization have a team in place specifically for managing supplier disputes and queries? How much time does AP staff spend each week managing suppler queries that are related to invoice discrepancies or process issues? | One of the main advantages of AP management software is the supplier dispute resolution service, as well as the supplier self-service tools that naturally reduce queries. This may help the organization strategically reallocate labor that was previously assigned to fixing manual-process-related issues. It is important to identify a solution provider that offers strong supplier services if disputes and queries are a significant issue in the organization. |

| What automation is already in place in the AP department? | Many solution providers offer their solutions in a modular fashion and can integrate easily with existing systems and tools. This means that if the organization already has a few AP automation tools in place, such as a data capture tool or an electronic payments tool, they can still move forward to complete the automated invoice lifecycle with more software tools. |

| What systems are in place in other areas of the back office? (e.g., electronic procurement solutions) | Solution providers can integrate with other P2P systems, creating a more seamless back-office environment. They may also offer some P2P system tools themselves, which can be appealing if the organization hopes to, one day, scale automation throughout the back office. |

| Does the organization plan to use the workflow tool for other types of back-office documents? | Examples of these would be human resources (HR) or legal documents. Some companies have stacks of paper documents and internal data they need to consolidate and secure. For these companies, it can be more appealing to opt for a solution that offers more general document management software over one that is strictly focused on AP. These tools often still offer advanced workflow capabilities, but can be used across many departments and processes. This can be a suitable choice for companies with limited budgets but extensive document management problems, or for companies with many existing back-office solutions in place, but a desire to close any remaining gaps with a versatile, general tool. |

| What ERP(s) does the organization use? | Some companies use several instances of one ERP, while some use several ERP systems across different departments or locations. It is important to make sure that the software provider has the necessary integrations for the organization’s specific ERPs and their other existing systems. |

| What is the organization’s revenue? | Many IWA providers have experience in marketing and designing their products for a few specific revenue segments. It is important to make sure the provider has a product set suitable for the organization’s own financial needs and business structure. |

| What is the organization’s industry? | As this report has shown, invoice management techniques and issues vary by industry. Just as with revenue, many providers target or have more experience with specific industries than others. The organization should find a solution that can meet its industry-specific needs. |

| What is the organization’s operational scope? | If the organization operates overseas, they must be able to handle the diverse set of global invoice requirements that exist in many international regions, such as VAT reporting requirements in Latin America and Europe, or those related to the Golden Tax System in China. A strong global-focused provider will offer at least some support to help its clients manage these processes. It should also offer support for managing more than one currency and language, even to the extent of offering OCR data capture technology that can read and extract data in more than one language. |

Question

How many invoices a year does the organization process? How many of each type?

Relevance

This contributes to the current state analysis. Organizations should make sure they identify the overall number of invoices and number by each type (spend type, local vs. global, based on priority, utility vs. goods, etc.). This will help create a map that shows where invoices go—and ensure the solution provider can handle the invoice volume and different types.

Question

What are the percentages of invoice receipt types?

Relevance

This entails segmenting the current number of invoices by paper, EDI, fax, email, and web portal receipt type. This will help the organization identify where they should start with automation, as the volume of different types may affect which provider the organization chooses. For example, a company with high volumes of paper may opt for a provider that offers mailroom services so that they can slowly phase their suppliers into more digital methods without disrupting the status quo too rapidly. Another company may receive the majority of their invoices in email format, and will have much less trouble onboarding their suppliers onto an eInvoicing network or pushing them to submit invoices via a web-based portal with a built-in data capture tool.

Question

How many suppliers does the organization have?

Relevance

This requires the organization to separate their suppliers by type (relationship length, priority based on spend, geographic location, etc.). This is also a good opportunity to identify which suppliers are sending the majority of paper invoices and to build out an onboarding strategy based on that and other supplier-related parameters.

Question

How many official AP approvers are responsible for invoice review and approvals?

Relevance

This will help the organization identify what type of workflow tool they will need, and how to configure role-based access. It may also help the organization identify inefficient or redundant approval patterns that can be restructured. Identifying all AP touches will be very important when it comes time to build out validation and approval workflows for invoices during implementation.

Question

How many touches outside of AP are typically involved per invoice?

Relevance

Some companies, particularly those in the middle market, take many purchases outside of centralized procurement departments and therefore require a more widespread set of reviews and approvals on PO-based invoices. In this case, the organization can look for a solution that offers a versatile, accessible, and controlled collaboration platform for non-AP users.

Question

Is the organization’s AP process centralized, decentralized, or somewhere in the middle? Does the organization plan to centralize AP?

Relevance

If the organization has a very decentralized AP process and no immediate plans to change that structure, the organization should identify a solution that can accommodate that structure without sacrificing control.

Question

Does the organization have a team in place specifically for managing supplier disputes and queries? How much time does AP staff spend each week managing supplier queries that are related to invoice discrepancies or process issues?

Relevance

One of the main advantages of AP management software is the supplier dispute resolution service, as well as the supplier self-service tools that naturally reduce queries. This may help the organization strategically reallocate labor that was previously assigned to fixing manual-process-related issues. It is important to identify a solution provider that offers strong supplier services if disputes and queries are a significant issue in the organization.

Question

What automation is already in place in the AP department?

Relevance

Many solution providers offer their solutions in a modular fashion and can integrate easily with existing systems and tools. This means that if the organization already has a few AP automation tools in place, such as a data capture tool or an electronic payments tool, they can still move forward to complete the automated invoice lifecycle with more software tools.

Question

What systems are in place in other areas of the back office? (e.g., electronic procurement solutions)

Relevance

Solution providers can integrate with other P2P systems, creating a more seamless back-office environment. They may also offer some P2P system tools themselves, which can be appealing if the organization hopes to, one day, scale automation throughout the back office.

Question

Does the organization plan to use the workflow tool for other types of back-office documents?

Relevance

Examples of these would be human resources (HR) or legal documents. Some companies have mountains of paper documents and internal data they need to consolidate and secure. For these companies, it can be more appealing to opt for a solution that offers more general document management software over one that is strictly focused on AP. These tools often still offer advanced workflow capabilities, but can be used across many departments and processes. This can be a suitable choice for companies with limited budgets but extensive document management problems, or for companies with many existing back-office solutions in place, but a desire to close any remaining gaps with a versatile, general tool.

Question

What ERP(s) does the organization use?

Relevance

Some companies use several instances of one ERP, while some use several ERP systems across different departments or locations. It is important to make sure that the software provider has the necessary integrations for the organization’s specific ERPs and their other existing systems.

Question

What is the organization’s revenue?

Relevance

Many IWA providers have experience in marketing and designing their products for a few specific revenue segments. It is important to make sure the provider has a product set suitable for the organization’s own financial needs and business structure.

Question

What is the organization’s industry?

Relevance

As this report has shown, invoice management techniques and issues vary by industry. Just as with revenue, many providers target or have more experience with specific industries than others. The organization should find a solution that can meet its industry-specific needs.

Question

What is the organization’s operational scope?

Relevance

If the organization operates overseas, they must be able to handle the diverse set of global invoice requirements that exist in many international regions, such as VAT reporting requirements in Latin America and Europe, or those related to the Golden Tax System in China. A strong global-focused provider will offer at least some support to help its clients manage these processes. It should also offer support for managing more than one currency and language, even to the extent of offering OCR data capture technology that can read and extract data in more than one language.

In order to help organizations select an IWA solution, the following section explores the features and services of a leading IWA software

provider.

Levvel Research, formerly PayStream Advisors, is a research and advisory firm that operates within the IT consulting company, Levvel. Levvel Research is focused on many areas of innovative technology, including business process automation, DevOps, emerging payment technologies, full-stack software development, mobile application development, cloud infrastructure, and content publishing automation. Levvel Research’s team of experts provides targeted research content to address the changing technology and business process needs of competitive organizations across a range of verticals. In short, Levvel Research is dedicated to maximizing returns and minimizing risks associated with technology investment. Levvel Research’s reports, white papers, webinars, and tools are available free of charge at www.levvel.io

PairSoft develops, sells, and supports advanced web-based and native mobile requisitioning, procurement, accounts payable, and expense solutions for mid-market organizations across a range of industries, worldwide. The user interface offers flexible Procure-To-Pay automation and robust expense reporting that is easy for employees, effective for management, and powerful for accounting.

Many organizations start with manual receipt handling, fragmented card feeds and slow AP processes. Implement AI agents to auto-capture receipts, route approvals, enable punch-out buys and post to the ERP.

Result: faster batching, fewer errors and cost savings. “This saves us hours every month.”

Many organizations face slow, paper-heavy AP and fragmented procurement that waste time and inflate costs. AI Agents can automate approvals, PO matching and record sync to improve speed, accuracy and control. Client quote: “It freed up hours and made our process reliable.”

Operational drag and rising costs slow growth: teams waste time on manual tasks, misaligned priorities and opaque processes. AI Agents help automate routine work and coordinate actions across teams. “We’ve lost time to repeats and handoffs,” says a typical client.

Companies struggle with manual procurement, fragmented approvals, and costly integrations that slow growth and obscure spend. Our AI Agents streamline requisitions, POs, and invoice matching to cut manual work and improve visibility. “We were wasting time and missing insights,” says a client.

Many teams start with fragmented PO/AP systems, manual matching and delayed financial reporting. Deploying AI agents to automate PO checks, real-time encumbrance tracking and invoice matching reduces processing time and errors, delivering live budgets and faster closes. “Finally, we can see current balances and approve instantly.”

Many companies juggle growing invoice volumes and legacy systems. They struggle with manual processes, compliance gaps and limited headcount. Our AI Agents automate integrations, enforce rules and surface exceptions. The typical outcome: faster closes and measurable ROI. “We stopped chasing invoices.”