Accounts payable (AP) is a critical component of any business, as it deals with the management and processing of supplier invoices and timely payments. However, AP departments are particularly vulnerable to fraud, making it essential for companies to implement effective measures to mitigate this risk and track their cash flow. One powerful solution for reducing fraud risk is integrating AP payments within an Enterprise Resource Planning (ERP) system alongside

AP automation. Here, we’ll explore how this automated payable process can greatly enhance security and reduce fraud risk for your vendor relationships and company.

Understanding the Fraud Risk in AP

Before delving into the advantages of accounts payable automation and payment automation within an ERP, it’s crucial to comprehend the nature of fraud risks associated with the manual AP process. Here are some common ways in which fraudulent activities can occur:

- Invoice Fraud: Fraudsters may submit fake invoices, overstate amounts, or manipulate invoice details to siphon off funds from your balance sheet.

- Duplicate Payments: Duplicate payments can occur due to manual errors, making it easy for fraudsters to exploit such situations for financial gain.

- Ghost Vendors: Creating fictitious suppliers and routing payments to these ghost vendors is a classic fraud tactic used in AP automation and procurement.

- Unauthorized Access: Without proper controls, unauthorized individuals can access sensitive AP data, alter records, payment methods, or make unauthorized payments.

- Insider Collusion: Employees working within the AP team may collude with external fraudsters or other employees to facilitate fraudulent payments.

Now, let’s explore how integrating AP payments within your AP automation software can help mitigate these risks.

Advantages of AP Payments Integration in ERP

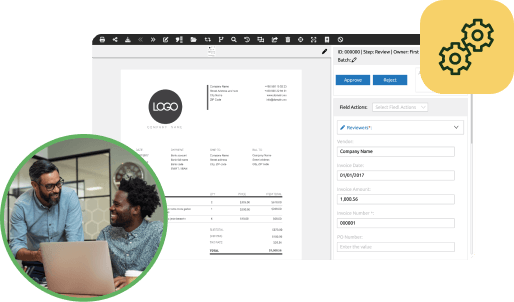

Enhanced Accuracy and Automation

Integrating AP payments into your ERP automates many aspects of the payment process, reducing the scope for manual data entry errors and fraud. ERPs are equipped with robust features that enable automated invoice matching and approval workflows, which cross-reference purchase orders, goods received, and supplier invoices. This eliminates the possibility of duplicate payments, one of the common fraud risks, as well as late payments generally. Automated workflows also ensure that all payments are properly approved, leaving little room for unauthorized payments.

Fraud Detection Algorithms

Modern ERP systems incorporate advanced analytics and fraud detection algorithms that can flag suspicious activities and discrepancies. For instance, if a supplier’s payment details suddenly change or if an invoice’s pricing amount deviates significantly from historical data, the system can generate alerts for further investigation, which manual processes cannot do. This feature is invaluable in detecting invoice fraud and unauthorized changes to supplier information.

Access Controls

ERP systems come with built-in security features that allow you to define who can access sensitive AP data and perform payment transactions. This minimizes the risk of unauthorized access to the system, making it harder for malicious individuals to manipulate records or initiate fraudulent payments. By implementing strong access controls, you can create a more secure environment for your AP department.

Audit Trail and Transparency

One of the key advantages of integrating AP payments within your ERP is the creation of a comprehensive audit trail. Every transaction and action is logged and timestamped, making it easy to trace the history of a payment from initiation to completion. This level of transparency discourages fraudulent activities and can serve as evidence in case of any suspicious activities.

Supplier Verification

ERPs can be integrated with external data sources to verify the legitimacy of suppliers. This helps in preventing ghost vendors and ensuring that payments are only made to legitimate entities. Supplier verification also reduces the risk of paying incorrect or fraudulent bank accounts.

Segregation of Duties

A critical control in fraud prevention is the segregation of duties. Integrating AP payments within an ERP allows you to enforce strict role-based access and responsibilities. This means that one person can’t both approve and initiate payments, reducing the potential for insider collusion. The ERP system enforces a separation of duties, ensuring multiple individuals are involved in the payment process.

Real-time Monitoring

With AP payments integrated into your ERP, you can monitor transactions in real time. Any unusual or high-risk transactions can be identified and addressed immediately. This proactive approach to monitoring fraud risk reduces the chance of fraudulent activities going undetected for extended periods.

Multi-factor Authentication

Modern ERPs often offer multi-factor authentication options, adding an extra layer of security to the payment process. This makes it significantly more difficult for unauthorized individuals to gain access to the system and initiate payments.

In today’s business landscape, where fraud risks are constantly evolving and becoming more sophisticated, companies need robust tools and strategies to protect their financial assets. Integrating an AP automation solution within your ERP is a powerful choice that greatly reduces fraud risk and late fees. By automating invoice processing, implementing fraud detection algorithms, enforcing access controls, and maintaining a clear audit trail, companies can optimize a more secure and transparent environment for their AP workflows.

Investing in an ERP system with AP payment integration not only enhances security but also streamlines the entire AP process, improving efficiency and reducing operational costs. In the long run, the benefits of reduced fraud risk and increased process efficiency make it a strategic investment that can contribute to the overall success of your business. So, if you haven’t already considered integrating AP payments within your ERP, now is the time to explore the possibilities and safeguard your company’s payable workflow.