Accounts payable (AP) processes have always involved manual processes such as invoice and document encoding. These not only take a lot of time to finish, but they are also highly prone to errors.

The good news is that businesses can take advantage of today’s technology to streamline repetitive and tedious tasks, such as B2B payments.

What are the advantages of AP automation in terms of B2B payments?

When the COVID-19 pandemic hit, businesses using automated AP solutions were prepared to support remote workers to ensure continued business operations. They also realized the benefits of AP automation on the B2B sector.

Here are some of those benefits.

1. Cost savings

It’s crucial for businesses to have full control and visibility over invoices, as it gives them better flexibility over their days payable outstanding (DPO), or the average time it takes a company to pay its invoices to suppliers.

For instance, a company can choose to pay earlier to secure discounts or ensure their suppliers’ trust. Businesses with a tighter budget, however, can opt to pay later to maintain a healthy cash flow.

AP automation can also help companies maintain a good financial status, as outdated processes will cost time, money, and human resources. For instance, errors in manual invoice and payment processing forces businesses to spend money to rectify the issue.

Also, manual processes require more manpower, which means higher expenses.

2. Better productivity

AP automation can also help keep B2B payments on track even during critical situations such as the current pandemic.

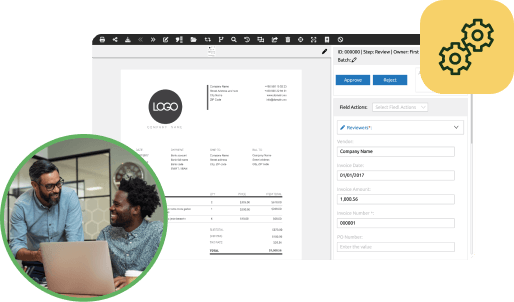

Cloud automation allows AP teams to work individually or together, no matter where they are or whatever device they use. It also allows for faster payment approvals and secure storage of financial data.

Through cloud automation, AP team members can find accurate vendor information, helping them gain financial insight through the AP workflow data. It also eliminates the need to manually check every piece of supplier information.

With cloud automation, your team’s productivity and efficiency will improve, even when they are working remotely.

3. Fraud protection

B2B transactions are prone to fraud, with ransomware and phishing attacks targeting businesses due to the continued use of paper-based and manual processes to capture, approve, and pay invoices.

According to the Association for Financial Professionals, business email compromise (BEC) is the most common payment fraud method today. BEC targets businesses working with suppliers and/or businesses regularly performing wire transfer payments.

It involves a hacker compromising an executive’s OR a high-level employee’s email and asking to wire funds for invoice payment to their own fraudulent account.

During a crisis like the COVID-19 pandemic, a company’s AP team also faces many difficulties. For instance, in-person invoice management procedures no longer apply, increasing the risk of internal fraud.

What’s more, since IT specialists have to find a way to allow AP teams to process invoices remotely, they risk creating software gaps and vulnerabilities that cybercriminals can exploit.

To protect your business from B2B fraud and invoice scams, be suspicious of requests for secrecy or pressure to take immediate action. Always verify changes in vendor payment locations and confirm fund transfer requests before processing the payment.

Double check sender addresses as well, as there are fraudulent email addresses that imitate legitimate ones (e.g., @acmecompany.net instead of @acmecompany.com).

Automation also enforces a strict adherence to your organization’s rules. The idea is to create permissions to prevent people from manually creating vendors, entering and approving invoices, and printing checks, among others. AP automation eliminates paper-based systems, which reduces overhead, and also protects your business from fraud.

Ready to improve your B2B payment processes? Start by partnering with PairSoft. We will help you automate your AP processes so you can leave paper-based systems behind, and ensure efficiency in your B2B payments. Learn more about how we can help you by scheduling a free personalized demo today.