Janet Martin

Janet joined the PairSoft team upon its merger with Paramount Workplace, where she was also an integral part of the sales team for years. Janet resides in Michigan with her family.

View all posts by Janet MartinJanet Martin • September 21, 2022

Making payments is a critical part of doing business, but keeping track of all the different types of payments businesses need to make can often be confusing. B2B payment processing includes accounts payable (AP), procure-to-pay (P2P) processes, and more.

In this post, we’ll break down everything you need to know about B2B payments: what they are, how they work within the accounts payable process, and the different methods available for making them.

By understanding B2B payments, you’ll be able to make more informed decisions about how to streamline your payment process with this payment gateway.

When two businesses agree to exchange goods or services, they must agree on how the payment will be made. This is where business-to-business payments come in. B2B payments involve the exchange of goods or services that are supplied for a certain value, and this value is denominated in the currency.

For example, a company may make a B2B payment to another company in exchange for products that they have purchased. Alternatively, a company may make a B2B payment to another company in exchange for services rendered.

B2B payments can be single transactions, like when you purchase office supplies from an online retailer, or they can be recurring transactions, like when you lease space from a commercial landlord. The payment terms, either single or recurring, will be set between the buyer and seller ahead of time.

B2B payments within procurement can be made in various ways, but the most common methods are credit cards, ACH payments, eChecks, wire transfers, and virtual cards.

Credit cards are one of the most common B2B payment methods and offer several advantages. Credit cards are widely accepted, provide a quick and easy way to make payments, and offer fraud protection. When used with a dedicated processing software or financial institution, they can also offer cash back.

ACH payments are electronic funds transfers (EFTs) typically used for recurring payments. ACH payments are a lower-cost alternative to wire transfers, but this payment option can take several days to process.

eChecks are another type of EFT payment that are similar to ACH payments. eChecks are typically used for one-time payments and offer many of the same advantages as ACH payments (lower costs, and faster processing times).

They are a digital payment type involving money being moved from one bank account to another. Wire transfers are safe and secure and typically do not have currency limits on transaction exchanges.

However, they can be time-consuming to set up and execute. For real-time payments, companies often use other online payment methods.

Also known as a “single-use account number,” virtual cards are unique credit card numbers generated for each transaction. Virtual cards offer businesses the same fraud protection as regular credit cards but can only be used for one-time transactions.

This makes them a safer option for companies making online payments. Virtual cards also typically have lower transaction fees than regular fintech credit cards.

Each B2B payment method has its own benefits and drawbacks, so choosing the option that best suits your needs is important. If you’re unsure which method is right for you, consult with expert B2B payment processing providers. They’ll be able to advise you on the best B2B payment method in the payments market.

Accounts payable payment is the process of a company paying off its debts to suppliers. It’s an important part of keeping a business running smoothly and allows a company to maintain a good relationship with its vendors.

Accounts payable payment is also tied into a company’s payment service. For small businesses, choosing the right payment service can mean the difference between paying (or getting paid) on time and paying late fees. The payment cycle includes several steps, from electronic invoicing to payment processing.

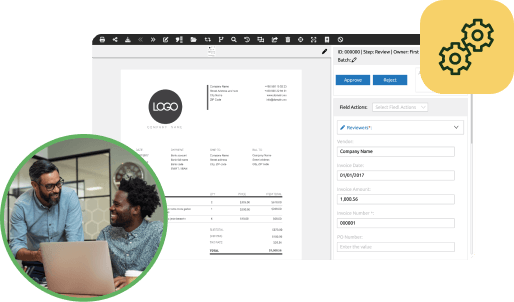

When it comes to B2B payments, payment delays caused by manual methods won’t cut it anymore. To stay competitive, startups need to take advantage of accounts payable automation. This system can streamline B2B transactions by automating repetitive tasks such as invoicing and consumer payments.

Not only does this make payment systems more efficient, but it also reduces the risk of human error. In addition, many accounts payable automation systems come with added functionality, such as fraud detection, which helps reduce the risk of fraud and reporting.

As a result, accounts payable automation can provide several benefits for businesses that rely on B2B payments.

Procure-to-pay (P2P) is a business process that handles the procurement of goods and services needed by an organization and the procedures for receiving and verifying them. P2P also encompasses accounts payable and accounting functions.

The goal of P2P is to streamline the process of procuring goods and services while ensuring that only quality products are purchased at a fair price.

In many cases, the B2B payment is the final step in the procure-to-pay process. Once the B2B payment is made, the transaction is complete, and both parties can move on. However, there are some situations where additional steps may be required.

For example, if the goods or services purchased were not delivered as agreed, the buyer may need to file a claim or dispute to receive a refund. Similarly, if the quality of the goods or services is not as expected, the buyer may need to request a credit from the seller.

The procure-to-pay process can vary slightly from one company to another. However, B2B payments always play a vital role in ensuring that transactions are completed smoothly and efficiently.

By understanding how B2B payments work, businesses can streamline their procure-to-pay processes and avoid payment delays or payment fraud.

B2B payments are vital to running a business smoothly. They’re also tied into accounts payable automation and procure-to-pay processes. By understanding how B2B payments work, businesses can use these systems to streamline their transactions and avoid delays or disruptions. Additionally, by keeping up with the latest trends in B2B payments, businesses can ensure that they get the most value out of their payment solutions.

Looking for a payment platform for your business? PairSoft’s full-service payments now integrate directly with our AP automation solution — get a demo today.

Get a free demo to learn how our tailored workflows have boosted the AP performance for organizations of all sizes.