Wadih Pazos

Wadih founded both PairSoft and PaperSave. He is an avid technologist who specializes in streamlining operations and maximizing productivity.

View all posts by Wadih PazosWadih Pazos

For larger enterprises, this situation might not be a big deal. However, smaller organizations with fewer monetary resources can be temporarily crippled by a late payment. These companies often need consistent cash flow in order to cover daily operating costs, and with paper invoicing, they are compromising their own abilities to prosper.

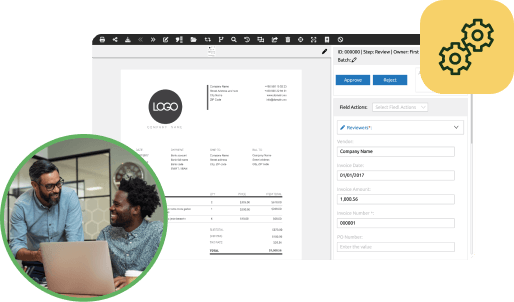

This is where e-invoicing comes in. An automated billing system can streamline the entire accounts payable process. Making payments on a virtual platform can be instant, and the organization sending the invoice can better track its transaction history.

A whitepaper written by Jason Busch, who serves as group managing director at Spend Matters, detailed the various ways in which e-invoicing can make billing and payment more organized and simplified. For example, the author noted that an invoice automation system can compile transaction-related data, offering new insights into company AP. In addition, he said that human errors can be – for the most part – eliminated with such a platform, since little manual intervention is typically required.

Two areas of AP processing that Busch highlighted as aspects that can be improved by an automated system are information entry and dispute management. Manual billing requires a person to enter payment information, but an e-invoicing system can automatically complete this task without the need for human authorization. Bush pointed out that invoice automation systems allow pre-validation of payment information to happen before the bill even reaches its recipient, which can contribute to speeding up the overall process.

Dispute management can be also streamlined by e-invoicing. Busch said that if a payment fails to be completed for any particular reason – outdated credit card information or the wrong amount being paid, for example – the system can send the invoice back to the party being billed without the need for manual intervention or approval. E-invoicing systems’ abilities to identify discrepancies and notify both the sender and the recipient of the invoice instantly can reduce time spent attempting to solve payment problems and recover cash that is owed.

Entrepreneur contributor Eyal Shinar wrote that small businesses that rely on cash flow to fund operating expenses often suffer from invoices going temporarily unpaid. He lamented that SMBs are sometimes at the mercy of clients or suppliers that are larger companies, and these organizations tend to be late with payments. Shinar cited a recent study conducted by Experian, which found that enterprises pay invoices eight days overdue, on average.

The simplest way to mitigate such a scenario, Shinar said, is to invest in accounting and invoicing software that can inform small businesses about and protect them from the possibility of late payments. E-billing can simplify the process for both the party with an outstanding invoice and the supplier. This can improve cash flow for SMBs, which can be crucial for revenue generation.

Shinar also suggested that accounting software can work in tandem with an e-invoicing platform to record and analyze transactional data, which can provide valuable insights for companies. He remarked that such a program can help tie accounts receivable and accounts payable together, consolidating the process and eliminating stress associated with billing.

Invoice automation can improve payments for both the client and the supplier, shortening the period of time between distributing an invoice and processing the return. An e-invoicing platform can lead to increases in cash flow, which can be a huge benefit for smaller companies.

Get a free demo to learn how our tailored workflows have boosted the AP performance for organizations of all sizes.

Many organizations start with manual receipt handling, fragmented card feeds and slow AP processes. Implement AI agents to auto-capture receipts, route approvals, enable punch-out buys and post to the ERP.

Result: faster batching, fewer errors and cost savings. “This saves us hours every month.”

Many organizations face slow, paper-heavy AP and fragmented procurement that waste time and inflate costs. AI Agents can automate approvals, PO matching and record sync to improve speed, accuracy and control. Client quote: “It freed up hours and made our process reliable.”

Operational drag and rising costs slow growth: teams waste time on manual tasks, misaligned priorities and opaque processes. AI Agents help automate routine work and coordinate actions across teams. “We’ve lost time to repeats and handoffs,” says a typical client.

Companies struggle with manual procurement, fragmented approvals, and costly integrations that slow growth and obscure spend. Our AI Agents streamline requisitions, POs, and invoice matching to cut manual work and improve visibility. “We were wasting time and missing insights,” says a client.

Many teams start with fragmented PO/AP systems, manual matching and delayed financial reporting. Deploying AI agents to automate PO checks, real-time encumbrance tracking and invoice matching reduces processing time and errors, delivering live budgets and faster closes. “Finally, we can see current balances and approve instantly.”

Many companies juggle growing invoice volumes and legacy systems. They struggle with manual processes, compliance gaps and limited headcount. Our AI Agents automate integrations, enforce rules and surface exceptions. The typical outcome: faster closes and measurable ROI. “We stopped chasing invoices.”