The average accounts payable (AP) department deals with a variety of issues on a regular basis. Often, these problems are caused by outdated practices—paper-based invoice processing, check writing, manual record-keeping, and the like.

If you’re noticing that the issues with your finances are becoming more costly, then it’s time to stop relying on manual AP processes.

What are the top challenges in accounts payable?

Here are some of the most common AP issues that can plague your business.

Slow processing

Manual invoice processing typically leads to lengthy approval timeframes. More often than not, an invoice can only be reviewed and signed by one person at a time. If your company has some form of payment authorization hierarchy, then routing invoices for approval is bound to take longer.

Slow processing can cause your business to fall behind on payments. When this happens, you risk facing other potential problems such as late fees and delayed shipment.

Missed or late payments can also impact your company’s credit rating and prevent you from getting favorable terms from suppliers and lenders.

Matching errors

Many AP departments perform three-way matching to ensure that payments are complete and accurate. This verification technique involves checking an invoice against the purchase order and order receipt to ensure that the details on each document match.

It’s a simple enough process, but performing it manually is labor-intensive, time-consuming, and highly susceptible to human error. Dealing with incorrect billing information, missing items, and other discrepancies will eat up even more of your AP department’s time.

Invoice exceptions

For many AP departments, invoice exceptions, or discrepancies between the details on the invoice and its supporting documents, are a huge drain on time and resources.

This is because AP staff have to manually look for and address incorrect, incomplete, or non-matching information, which often also involves following up with multiple parties on several occasions.

Lost invoices

Missing invoices can lead to a lot of finger-pointing. Not only does a lost and unpaid invoice cause internal discord, but it can also strain supplier relationships and even cause accounting problems.

For instance, if an accounts payable isn’t recorded in the balance sheet, and the expense is missing from the income statement, then you’ll have an inaccurate snapshot of your company’s financial position.

Double payments

There are many reasons why payments can be duplicated. Data entry errors, inconsistencies in invoice details, and invoices sent via multiple channels can result in an invoice being paid twice.

Additionally, it’s not uncommon for suppliers to submit a second payment request when the first one has not been paid by the agreed-upon date, increasing the possibility of duplicate payments.

Paying before the delivery of a product or service

Paying invoices before their due dates can earn your company supplier discounts and other benefits. However, AP staff may unwittingly send payments without checking the condition of the products or services, or if they were indeed delivered.

This can cause bigger problems, especially if goods are damaged or service wasn’t rendered. Paying bills early also reduces your business’s liquidity and restricts your cash flow.

How does AP automation solve these challenges?

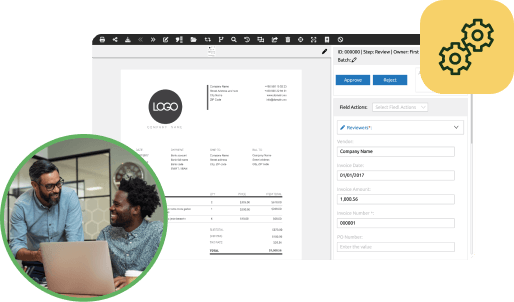

AP automation solutions streamline crucial steps in the AP process. PairSoft, for instance, enables users to collect invoice data and enter them into a workflow by simply taking a photo of the invoice using their smartphone or tablet.

The software extracts the data from the paper document, converts it into a digital file, then stores it in your database, all within a few seconds. This means your AP staff no longer need to manually key in information, thereby reducing the likelihood of costly mistakes due to typos and misinterpreted data.

Ultimately, AP automation solutions help your staff save time, minimize errors, and eliminate unnecessary manual work that’s preventing them from being efficient. Using these tools and software also improves visibility over your business’s finances and mitigates the risks of fraud and compliance issues.

To learn more about how PairSoft can boost the efficiency, transparency, and timeliness of your accounts payable process, schedule a free personalized demo today.